PPF: I don't worry about the April 5th "deadline"

The numbers show it doesn't matter much in the long term

I’m looking to understand who you are and what you’d like to read about! Please take a minute to take this survey: https://forms.gle/7r6VMKkT48NyjBcK7

Hi!

In my previous post on how I use PPF for my retirement, I mentioned how its interest is calculated:

The interest for a month is computed on the lowest balance between the end of 5th day and last day of the month, and the interest for the twelve months is deposited at the end of the financial year.

In this case, it would be optimal to invest the maximum Rs 1.5L before April 5th of the financial year to get the maximum interest. But we don’t all have that much money lying around to invest immediately, right?

To see if it actually makes a lot of difference, I calculated the corpus value at the end of each year for these investing approaches:

Investing Rs 1.5L before April 5th of the financial year

Investing Rs 1.5L after 6th March, but before 31st March of the financial year

Investing Rs 12.5k monthly before 5th of the month

Investing Rs 12.5k monthly after 6th but before the end of the month.

Interest Calculation

In case the one-liner above on PPF’s interest calculation didn’t make sense (like it did for me till I tried these calculations), here’s an example:

Say it’s the new financial year, and my PPF balance is Rs 1,50,000. I invest Rs 50,000 on April 3rd, and then Rs 1,00,000 on April 15th. The interest rate is 7.1%.

My interest calculation would look like this:

Interest for the month of April:

Interest for April = (Balance till 5th April)*(((rate)/100)/12)which turns into:

Interest for April = (1,50,000 + 50,000)*(((7.1/100)/12))

= 1,183Even though Rs 1,00,000 was invested on April 15th, it will not be considered for April’s interest calculation since the cut-off is April 5th.

Similarly, for the month of May:

Interest for May = (Balance till 5th May)*(((rate)/100)/12)which turns into:

Interest for May = (3,00,000)*(((7.1/100)/12))

= 1,775and so on.

In the calculations, the interest for the month is not added immediately. Interest is credited only at the end of the year.

Results

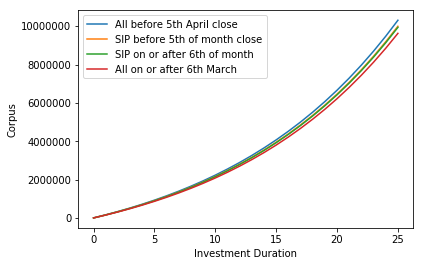

For a very high level result, here is a graph of how the numbers compare1:

Some assumptions:

Interest rate is 7.1% throughout

Corpus starts at 0

We invest Rs 1.5L every year

As expected, investing Rs 1.5L before the close of 5th April creates the highest corpus, and investing Rs 1.5L after 6th March creates the lowest corpus. What’s interesting is that SIPs with dates before and after 5th of the month don’t have much of a difference in the corpus size.

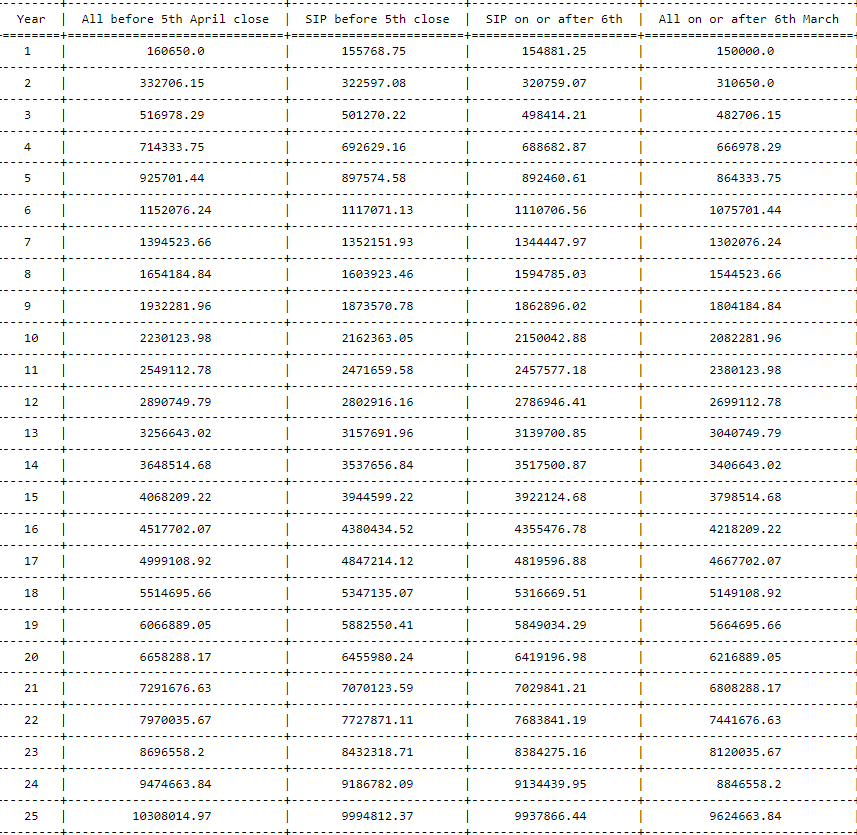

Here are the numbers for a closer look:

At the end of 25 years, the difference between the maximum corpus and the minimum corpus is only about Rs 6.8L. Considering inflation, that difference in real terms is even lower.

Also, the difference between locking in Rs 1.5L right away at the start of the financial year and an SIP over the year is only about Rs 3.7L.

I think the opportunity cost of not investing Rs 1.5L before April 5th is not much in the grand scheme of things. Using an SIP or even investing Rs 1.5L over the year whenever I have money, I can be comfortable in my investments. I don’t need to scramble to collect the money and invest by April 5th. I don’t have my money locked-in, and can allocate that money to other pressing needs if needed and then compensate later in the year.

Wrapping up

I don’t worry about investing all of my money at the start of the year into PPF. It’s OK to pace myself, and as long as I invest the required amount before the end of the year, I will be okay.

Please don’t forget to take the survey: https://forms.gle/7r6VMKkT48NyjBcK7

Until next time!

In case you’d like to look at my hacky code, here’s a PDF of the Jupyter Notebook: